The shipping costs to Eastern Africa are bound to remain high following the recent decision by some shipping lines to totally avoid the Red Sea route from amid mounting safety concerns caused by Houthi attacks.

Maersk and Hapag-Lloyd, said a joint statement late last year that their new alliance, the Gemini Cooperation, would bypass the Red Sea from February 1, 2025.

Mediterranean Shipping Company (MSC) in January suspended transit through the Suez Canal, amid conflict in the Middle East.

Instead, they will begin using the Cape of Good Hope at the southern tip of Africa. This will come with surcharges.

The decision to take the longer route around Africa was made “after thorough consideration and given the continued safety concerns in the Red Sea,” the companies said in a customer advisory, indicating that they expect to “phase in their Cape of Good Hope network for the commencement of the Gemini Cooperation on 1 February 2025.”“As the situation remains highly dynamic, Hapag-Llloyd and Maersk will return to the Red Sea when it is safe to do so,” they said.

The announcement, even though indefinite, could be a big blow in the supply chain, which must now endure higher costs. But it also signals lower revenues for Egypt, which relies on the Suez Canal to charge ships a fee for using a shorter route into Eastern Africa.

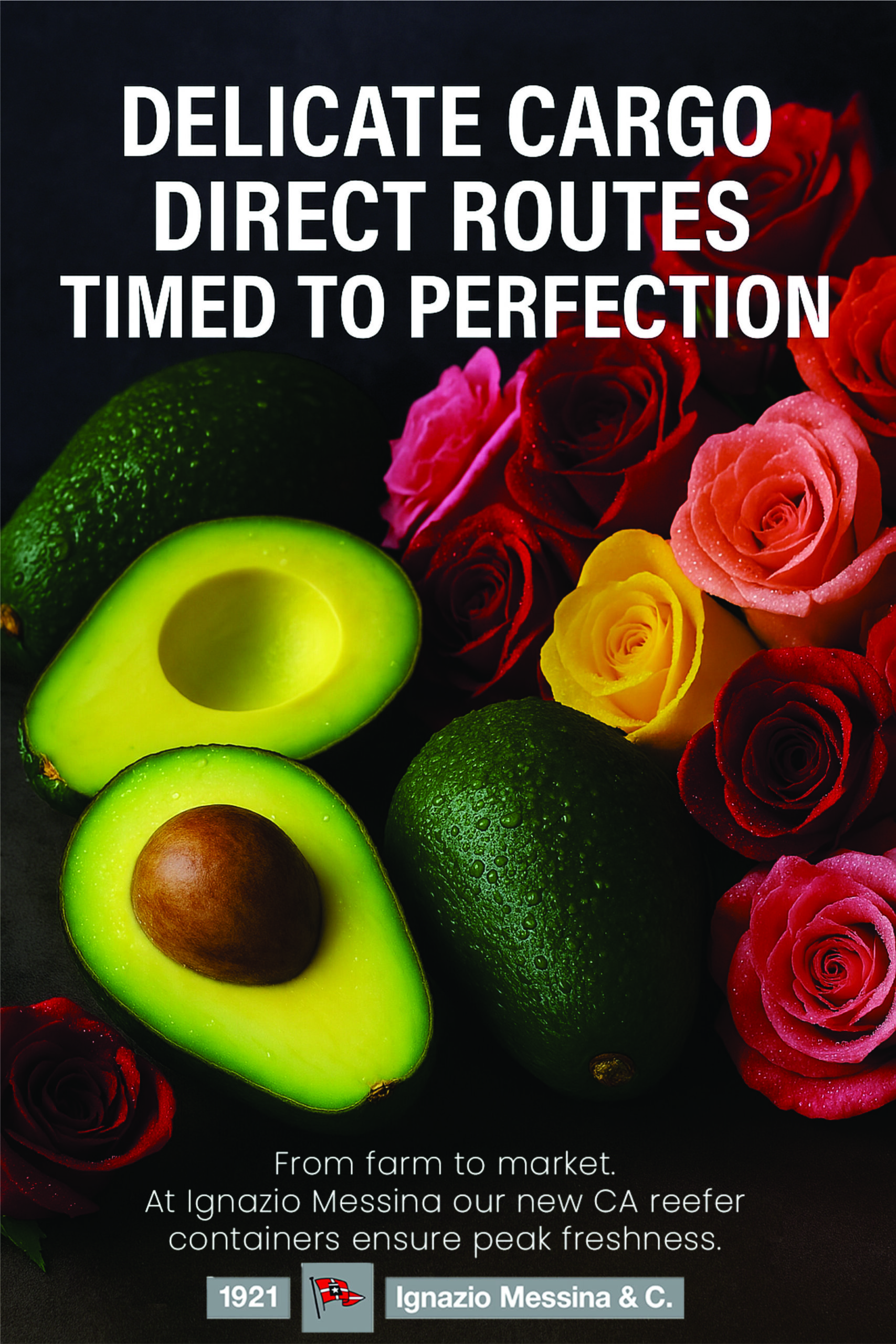

The Suez Canal Authority (SCA) said earlier it had incurred $6 billion in losses in the last eight months of this year as Houthi rebels in Yemen targeted ships owned by Israel or its allies.“The Red Sea impact has been massive, as there would be a delay in getting supplies, with fresh produce dealers such as avocado who use sea most affected, as it will take longer transit time by over 12 days.“We expect an increase in operational costs for the vessels considering that, already, there has been an imposition of a surcharge on transit disruption for referred containers and other cargo due to unrest in the Red Sea,” said Ogayo Ogambi, CEO of the Shippers Council of Eastern Africa.

Mr Ogambi said the decision could affect moves by countries such as Kenya, which have sought to shift exports from air to sea. Kenya launched targets to switch exports shipped out by air to sea by 2030.“As of today, the disruption of the Suez Canal has created a shortage of not only perishable but also normal containers due to the increased cargo delivery time such as avocado in East Africa but also tea and coffee supply chains,” he said.

The Red Sea, and the Suez Canal in particular, as an important link route to the European market, is the most important, accounting for 26 percent of all imports in terms of value into African countries, and the first destination for 26 percent of all African exports in terms of value, the Council says.

The price of freight for ships heading to Red Sea ports has risen to $6,800 per container, compared to $750 per container before the crisis.

Additionally, fuel and insurance costs have surged, posing unprecedented challenges to the maritime transport industry and affecting navigation rates in the Suez Canal.

Early this year, shipping lines introduced Transit Disruption Surcharge as a result of Houthi attacks of $200 and $400 for 20-foot and 40-foot container respectively, and $450 for a reefer container.

Apart from that, traders were slapped with Emergency Contingency Surcharge of $250 for 20-foot container and $500 for 40-foot container as well as reefer container.

Since last November, the Iran-backed Houthi militia has been launching drone and missile attacks on cargo ships sailing in the Red Sea, Bab al-Mandab and the Gulf of Aden off the coast of Yemen, claiming that this is in support of Gaza, which has been subjected to a devastating Israeli war since October 7, 2023. These attacks have negatively affected shipping, trade and global supply chains.

As a result, the United States formed a military coalition and, since the beginning of this year, it has been carrying out strikes alongside Britain, which it says target the Houthis’ military capabilities, in response to their attacks on cargo ships, which the Houthis responded to with attacks on

American and British naval ships, considering them “military targets.”

Maersk Line is a Danish international container shipping company and the largest operating subsidiary of Maersk, a Danish business conglomerate. Founded in 1928, it is the world’s second largest container shipping company by both fleet size and cargo capacity, offering regular services to 374 ports in 116 countries. As of 2024, it employed over 100,000 people. Maersk Line operates over 700 vessels and has a total capacity of about 4.1 million TEU.

In 2024, Maersk Line contributed significantly to African trade by expanding its presence, investing in new technologies, and adapting to the challenges of the Red Sea crisis, ultimately boosting trade and logistics in the region.

As one of the world’s largest container shipping companies, second only to Mediterranean Shipping Company (MSC), Maersk Line moves 12 million containers every year and deliver to every corner of the globe.

Maersk’s total revenue reached US$55.5 billion in 2024, with Ocean revenue rising to US$37.4 billion, Logistics & Services growing to US$14.9 billion, and Terminals revenue increasing to US$4.5 billion. Hapag-Lloyd AG on the other hand is a German international shipping and container transportation company, the 5th biggest in the world. It was formed in 1970 through a merger of Hamburg-American Line (HAPAG) and Norddeutscher Lloyd.